net working capital is defined as chegg

They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due and. Available cash minus current liabilities.

Solved In The Cobb Douglas Production Function Y Ak Alpha Chegg Com

Available cash minus current liabilities.

. Total liabilities minus shareholders equity. Current assets minus current liabilities. Current liabilities minus shareholders equity.

Changes in working capital. Working Capital Current Year Current Assets current year Current Liabilities current year Calculate Changes in Net Working Capital using the formula below. The depreciated book value of a firms fixed assets.

Total assets minus total liabilities. Net working capital is best defined as. In other words it represents that funds an entity has to cover short-term.

Current assets -. Changes in Net Working Capital Formula Working Capital Current Year Working Capital Previous Year. Current assets minus current liabilities.

Excess cash on hand. The depreciated book value of a firms fixed assets. Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year.

Total assets minus total liabilities. Total assets minus total liabilities. Net working capital is defined as.

Net working capital is defined as. This is the net change in fixed assets before the effects of depreciation. The financial statement that summarizes a firms accounting value as of a particular date is called the.

The definition is articulated by way of stating clearly what account balances are included in andor excluded from net working capital. Current assets minus current liabilities. Fixed assets minus long-term liabilities.

Maximize current dividends per share of the existing stock. Net working capital is the aggregate amount of all current assets and current liabilities. The accounting statement that measures the revenues expenses and net income of a firm over a period of time is called the.

Net working capital is defined as. The accounting statement that measures the revenues expenses and net income of a. Changes in fixed assets.

The analysis performed on net working capital together with the adjustments identified serves as the basis for a detailed definition of net working capital in the purchase and sale agreement. Net working capital is defined as. Definition of Net Working Capital.

This is the net change in accounts receivable accounts payable and inventory during the measurement period. Net working capital is the difference between a businesss current assets and its current liabilities. More Why You Should Use Days Sales of Inventory DSI.

A firms current assets. The available current or short-term assets of a firm such as cash receivables inventory and marketable securities that are used to finance its day-to-day operations. Net working capital is a liquidity measure that represents the amount of current assets in excess of current liabilities.

Other term for working capital. An increase in working capital uses cash while a decrease produces cash. Operating represents assets or liabilities which are used in the day-to-day operations of the business or if they are not interest-bearing financial.

Current assets minus current liabilities. Capital recovery must occur before a company can earn a profit on its investment. From time to time our in-house team evaluates the quality of your answers for accuracy and conformance to answering guidelines and shares a feedback report on your registered email ID as and when these evaluations are completed.

Operating working capital is defined as operating current assets less operating current liabilities. Therefore it can be calculated as follows. Hence the formula is.

Net working capital is calculated using line items from a businesss balance sheetGenerally the larger your net working capital balance is the more likely it is that your company can cover its current obligations. Working capital or net working capital NWC is a measure of a companys liquidity operational efficiency and short-term financial health. Net working capital represents the cash and other current assetsafter covering liabilitiesthat a company has to invest in operating and growing its business.

Net working capital is also known as working capital Example of Net Working. Current assets minus current liabilities. Total assets minus total liabilities.

Net working capital current assets minus current liabilities. The value of a firms current assets. Capial recovery is the earning back of the initial funds put into an investment.

The value of a firms current assets. Working capital management is a strategy that requires monitoring a companys current assets and liabilities to ensure its efficient operation. The primary goal of financial management is to.

Cash and marketable securities 2. Cash and other financial assets are typically excluded from operating current assets and debt. It is used to measure the short-term liquidity of a business and can also be used to obtain a general impression of the ability of company management to utilize assets in.

The goal of working capital management is to ensure that a company can afford its day-to-day operating expenses while at the same time investing the companys assets in the most productive way. Net working capital is the amount as opposed to being a ratio remaining after subtracting a companys total amount of current liabilities from its total amount of current assets.

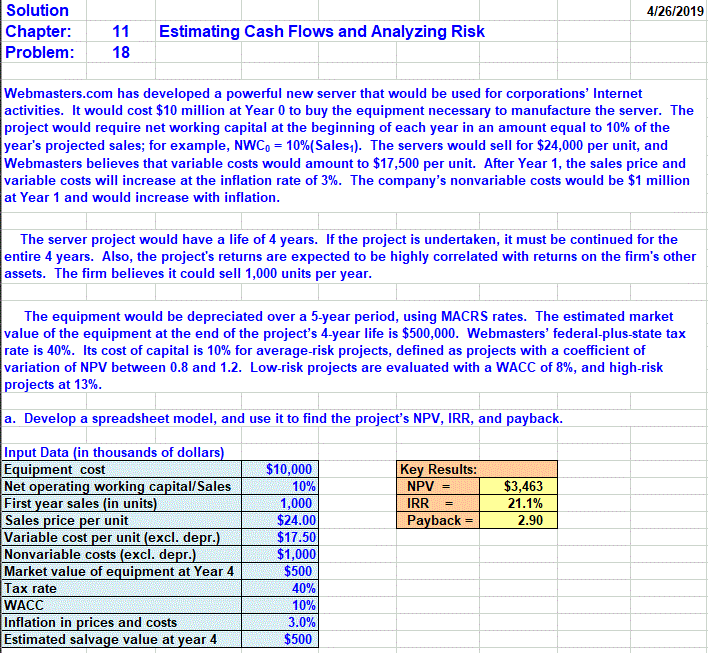

Solution 4 26 2019 Chapter Problem 11 18 Estimating Chegg Com

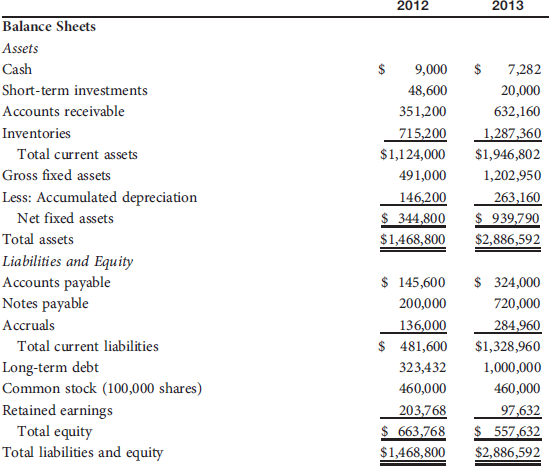

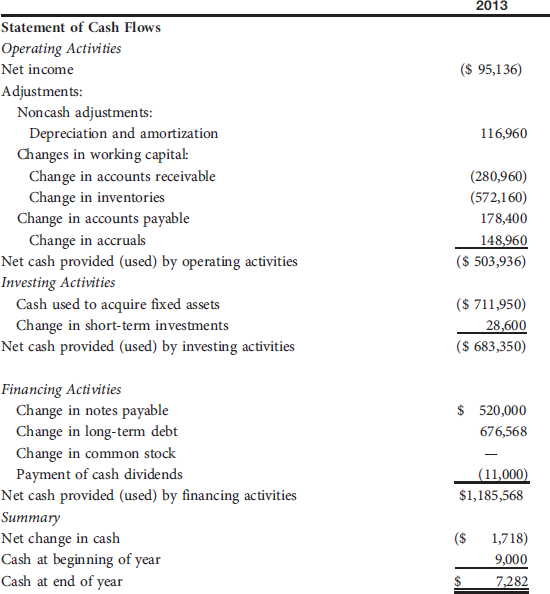

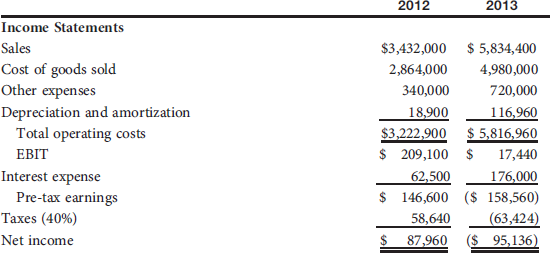

Chapter 2 Solutions Financial Management 14th Edition Chegg Com

Chapter 2 Solutions Financial Management 14th Edition Chegg Com

Solved Complete The Table By Calculating Physical Capital Chegg Com

Solved Consider A Small Island Country Whose Only Industry Chegg Com

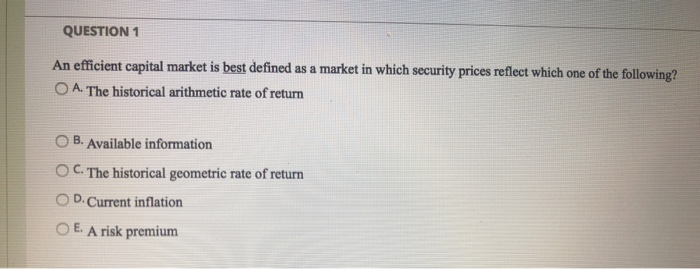

Solved Question 1 An Efficient Capital Market Is Best Chegg Com

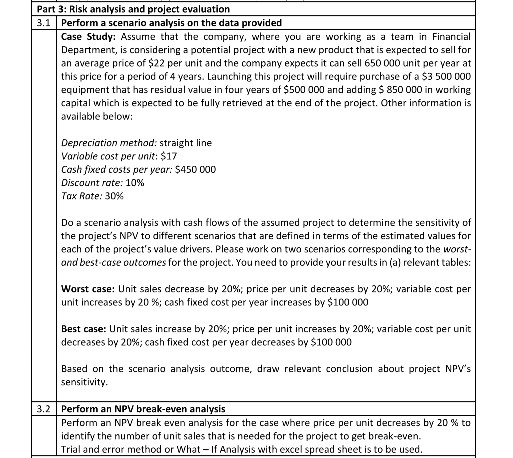

Solved Need Full Answer By Showing The Table Of Npv Based Chegg Com

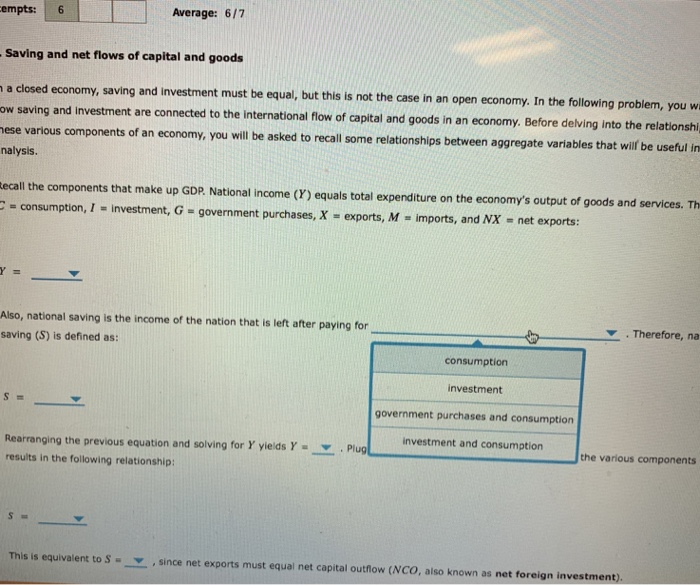

Solved Ttempts 6 Average 6 7 S Saving And Net Flows Of Chegg Com

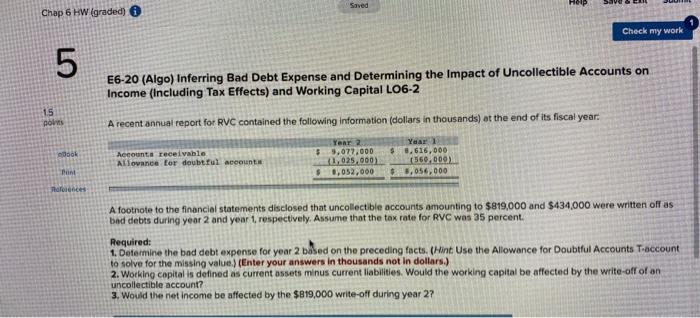

Solved Saved Chap 6 Hw Graded Check My Work 5 E6 20 Algo Chegg Com

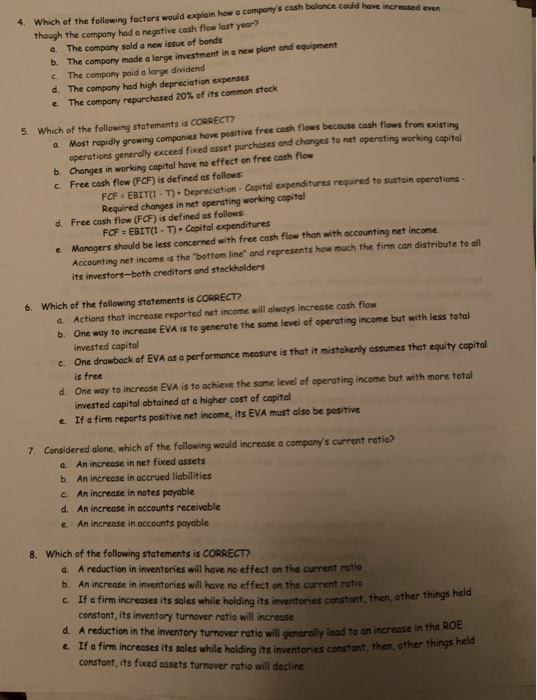

Solved A 4 Which Of The Following Factors Would Explain How Chegg Com

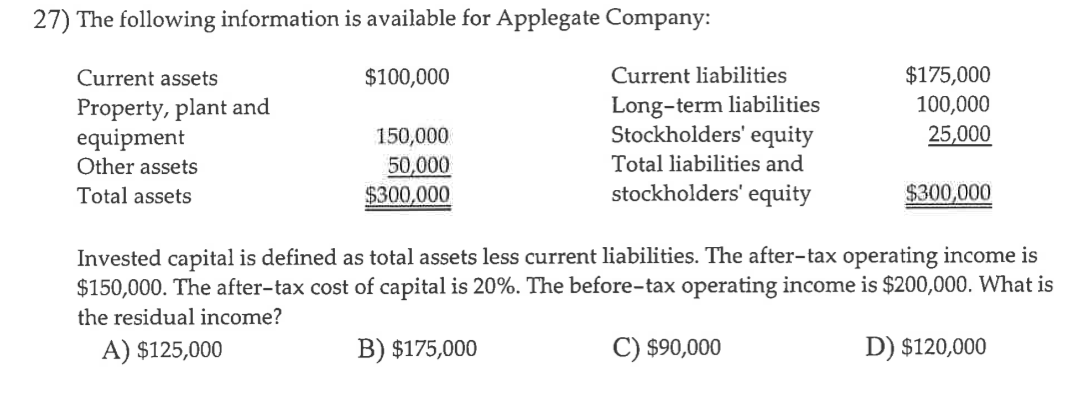

Solved The Following Information Is Available For Chegg Com

Chapter 2 Solutions Financial Management 14th Edition Chegg Com

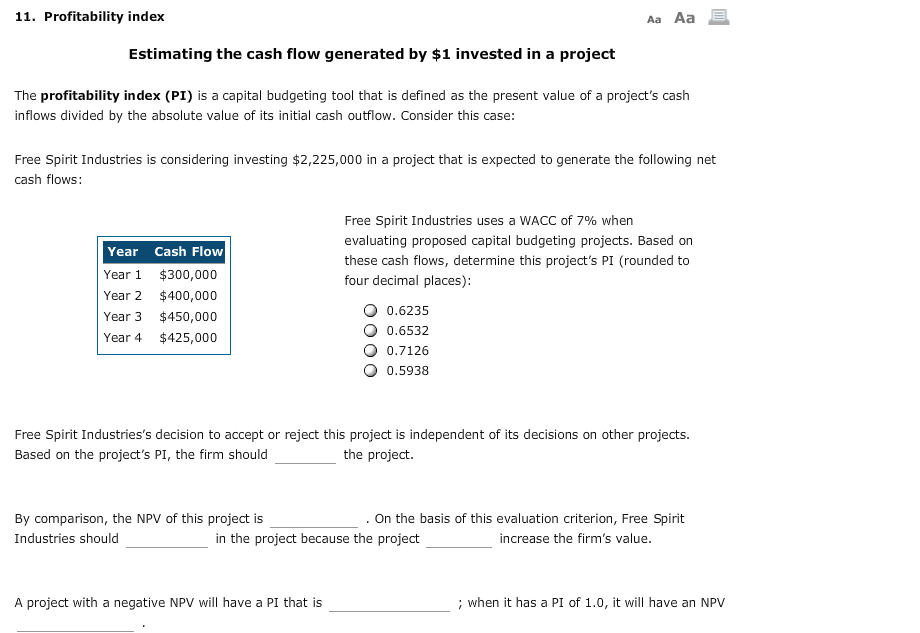

Solved 11 Profitability Index Aa Aa Estimating The Cash Chegg Com

Solved Please Answer Completely In Detail Need To Show All Chegg Com

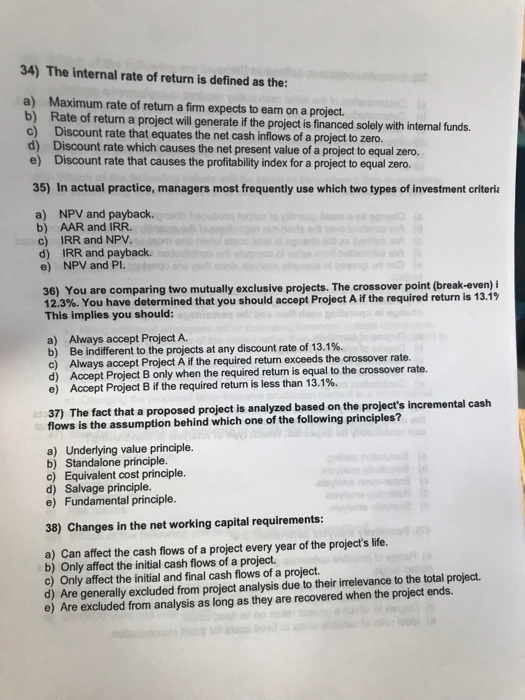

Solved 34 The Internal Rate Of Return Is Defined As The A Chegg Com

Solved Use The Following To Answer Questions 7 58 The Chegg Com

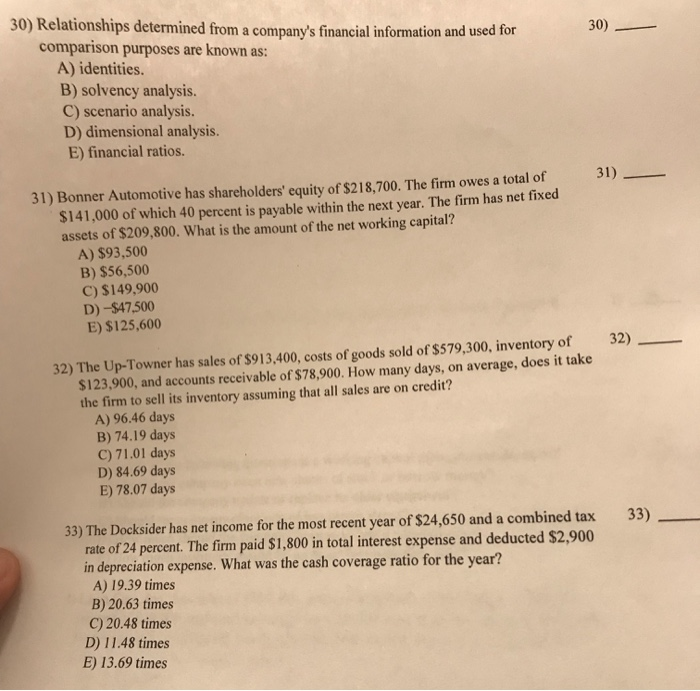

Solved 30 30 Relationships Determined From A Company S Chegg Com

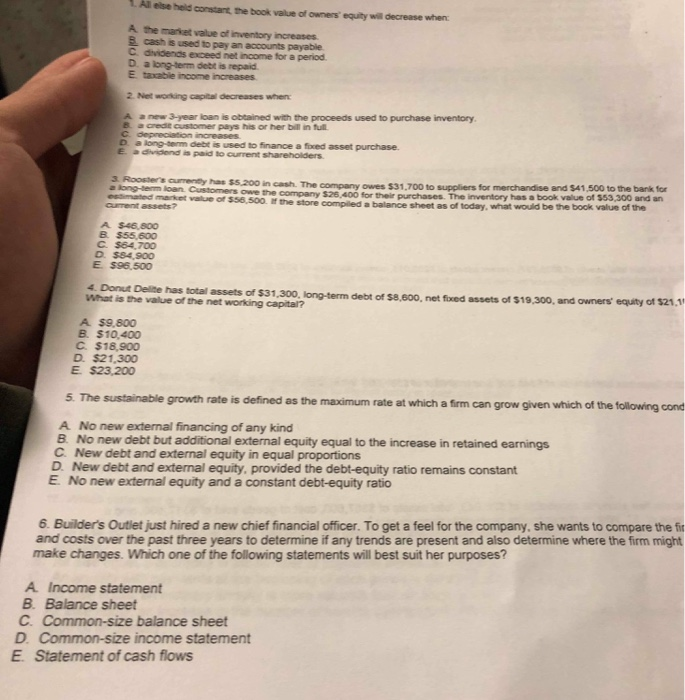

Solved T All Else Held Costat Tebok Valu Ofowners Equity Chegg Com

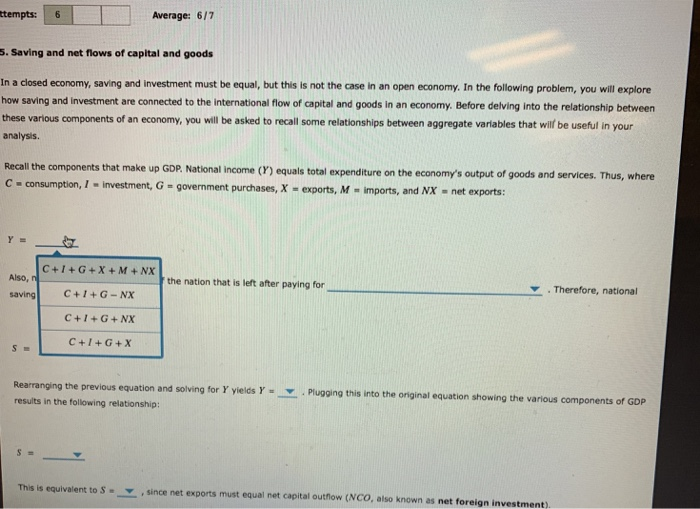

Solved Ttempts 6 Average 6 7 S Saving And Net Flows Of Chegg Com